NEW

Discover Pathfinding

Experience Lightning Payment Operations.

Confidence in every connection, precision in every payment.

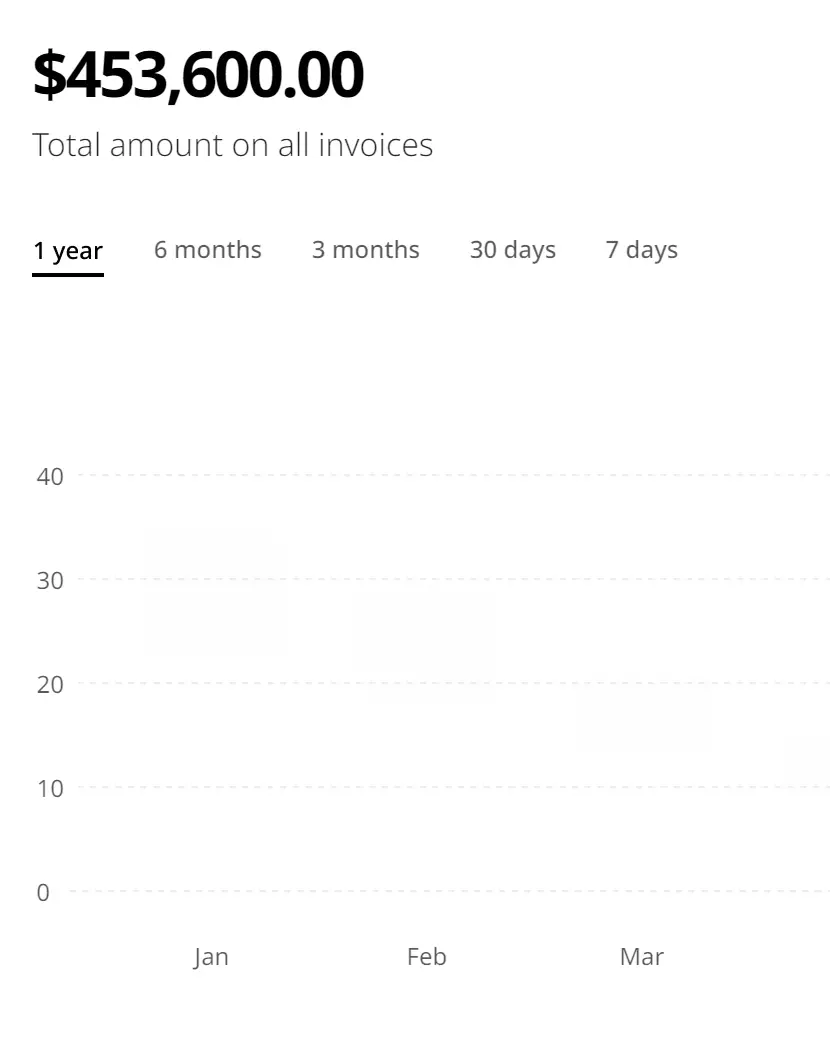

Reflex is a payment operations platform for the Lightning Network — from optimizing liquidity to proactive risk management with actionable insights.

Discover key features

Advanced

Risk Management

Streamline compliance duties with automated alerts and report generation. Our advanced risk management enables configurable automation for Anti-Money Laundering (AML) policies, including OFAC, ransomware, and sanctions.

At-a-Glance Risk Assessment

Actively screen channel peers for illicit finance categories and sanctions using IP address and funding source policies.

Continuous Monitoring

Regularly screen historical payments and network peers to produce alerts based on configurable risk categories.

Simplified Reporting

Generate robust reports to demonstrate consistent policy application using deterministic, verifiable compliance policies.

Coming Soon

Explore workflows

Maximize efficiency and reliability in your node checks workflow. Embrace flexibility by selecting your preferred methods and tools. Our seamless workflow ensures thorough checks while enhancing productivity.

See the documentationNEW

Try node monitoring

Why Reflex?

Renowned Lightning Data Analytics

Actively screens channel peers, using IP address and funding sources, against sanctions, facilitating lawful and problem-free payment peering.

Efficient Risk Management

Reflex effectively manages operational risks, ensuring smoother and compliant operations on the network.

Insight-Driven Decision-Making

Harness the power of our precise and insightful analytics to make informed and strategic decisions, fine-tuning your approach and enhancing your impact on the Lightning Network.

Explore use-cases

Explore real-world applications

To help illustrate the versatility and efficiency of Reflex, we present a series of real-world use cases demonstrating how our innovative solution is revolutionizing operations for various users on the Lightning Network.

Robust Risk Management

for Enterprise Adopters

Email and webhook alerts for OFAC-sanctioned funding sources identified within each Lightning channel.

Node-level OFAC risk assessments for IP addresses and payment paths, avoiding sanctioned nodes.

Continuous transaction monitoring, ensuring comfort with every payment.

Right-Sized Risk Management

for Native Startups

Run clear, deterministic checks for channels’ source of funds, IP-derived node locations, and associations (peers-of-peers).

Employ optional invoice checks, selectively or holistically, fine-tuning according to your risk appetite.

Generate clear, concise reports for delivery to legal and compliance teams, and other external stakeholders.

Optimal and fallback path recommendations for enhanced payment readiness.

Fast response times and increased visibility of Lightning Network paths.

Determinations when a payment path is not possible.

Ready to transform your Lightning experience?

Position your business at the forefront of Lightning. Embark on a journey with us to discover new horizons and strengthen your Lightning operations.

Sign Up